December 8, 2023

Top Reasons for Hiring a UK Mortgage Broker Explained

Embarking on the journey to homeownership can be as daunting as it is exciting. You're about to make one of the biggest financial decisions of your life, and you want to get it right.

That's where a mortgage broker comes in, a pivotal ally in navigating the complex waters of property finance. They're the experts who can match your unique financial situation with the right mortgage product.

In this article, we'll explore the indispensable benefits a mortgage broker brings to your property purchasing experience. You'll learn why their expertise could be the key to unlocking better rates, more suitable terms, and a smoother path to getting your dream home.

Why Do You Need a Mortgage Broker UK?

When you're venturing into the complex world of mortgages, a broker can transform your experience from daunting to manageable. Navigating the mortgage market by yourself is an intricate process.

In contrast, mortgage brokers are industry insiders with a pulse on the latest trends, rates, and financial regulations. They anticipate shifts in the market and adapt strategies to benefit you.

A mortgage broker's network is vast, connecting you to more lenders than you’d likely find on your own. This access opens doors to exclusive deals and products otherwise unavailable to the public.

For example, some lenders work exclusively with brokers, implying that you could miss out on preferential rates and terms without one.

Personalised financial solutions are another cornerstone of what a mortgage broker delivers. Your financial circumstances are unique, and cookie-cutter solutions simply won't do.

Brokers take the time to understand your financial landscape and tailor options that align perfectly with your needs. Whether you're self-employed, buying an unusual property, or facing credit challenges, a broker's expertise is invaluable.

Moreover, brokers handle the paperwork, saving you a considerable amount of time. They know exactly what's needed for a successful application and streamline the process, ensuring that your documents are in order and submitted on time.

Their role extends beyond finding home loans; they also work as your advocate throughout the negotiation process, often securing terms that could save you thousands over the life of your mortgage.

Therefore, securing an adept broker could be the difference between an offer that goes through and one that falls flat.

Access to Diverse Lenders

Tailor-Made Mortgage Solutions

Streamlined Paperwork and Application Processes

Expert Negotiation on your behalf

By leveraging the skills and connections of a mortgage broker, you’re positioning yourself to achieve favourable outcomes in a competitive and ever-changing property market.

Benefits of Using a Mortgage Broker

When you're navigating the complex waters of securing a mortgage, the support of a knowledgeable mortgage broker can be invaluable.

Not only do they bring a suite of benefits to the table, but they also ensure that you're equipped with the resources and information necessary to make informed decisions about your home purchase.

1. Access to a Wide Range of Lenders

Mortgage brokers have relationships with a vast network of lenders, including some you might not have access to on your own.

They can approach both mainstream banks and specialist financing institutions, providing you with an ample selection of mortgage products that cater to various needs and circumstances.

This level of access means you're not limited to the offers available from a single lender, which significantly improves your chances of finding a loan that’s a perfect fit for your financial situation.

Mainstream Banks: Often favoured for standard mortgage products.

Specialist Lenders: Provide solutions tailored for unique borrowing scenarios.

By engaging a broker, you'll be able to compare rates and terms from multiple lenders effortlessly, ensuring you get the most competitive deal available.

2. Expert Advice and Guidance

Your mortgage broker is more than just a middleman. They're seasoned professionals armed with up-to-date knowledge of the market trends, legal requirements, and potential pitfalls in the mortgage application process.

A broker helps you understand complex financial terminology and what it means for your personal circumstances, enabling you to make choices with confidence.

Whether you're navigating bad credit concerns or aiming for the best interest rates available, a broker’s specialized advice will likely prove invaluable across the board.

Additionally, they often have insights into products that are not advertised to the general public, which could provide you with advantages that go beyond the standard market offerings.

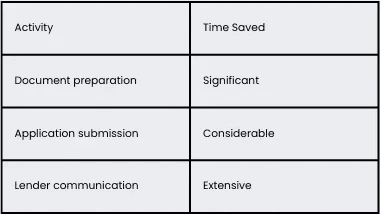

3. Time and Effort Saved

Securing a mortgage can be a time-consuming task, filled with paperwork, negotiations, and numerous meetings. Fortunately, a mortgage broker can take this burden off your shoulders.

They handle the legwork of gathering documents, submitting applications, and liaising with lenders on your behalf.

Brokers streamline the mortgage process, making it more efficient and less stressful for you. Their expert handling of negotiations can also translate into quicker acceptance times and smoother overall progress toward securing your home loan.

Saving time and effort in these crucial stages allows you to focus on finding your dream home while the financial details are managed by a professional.

By taking advantage of a mortgage broker's expertise and connections, you'll be well on your way to discovering the best mortgage solutions tailored to your individual needs, without the hassle and complexities that could otherwise overshadow your homebuying experience.

The Mortgage Application Process

1. Preparing Your Finances

Embarking on the mortgage application process requires careful financial preparation. You'll need to take a close look at your budget, savings, and credit history to ensure you're in the best position to apply for a mortgage.

It's essential to gather all relevant financial documents, including bank statements, pay slips, and proof of assets.

Getting your finances in order is critical. Lenders will evaluate your credit score, which reflects your creditworthiness. A higher credit score often translates into more favourable mortgage terms.

Additionally, saving for a substantial deposit can significantly improve your loan terms and reduce monthly repayments.

Budgeting effectively to account for potential homeownership costs can show lenders you're financially responsible and prepared for the commitment of a mortgage.

Also, don't forget to consider additional fees like valuation costs and solicitor charges, which need to be factored into your budget.

2. Finding the Right Mortgage Deal

Finding the right mortgage deal is akin to finding a needle in a haystack—time-consuming and challenging without expert help.

This is where a mortgage broker comes into play. With their in-depth knowledge of the market, they can sift through numerous deals to find one that aligns with your financial situation.

When it comes to mortgage deals, interest rates and repayment terms vary widely. A mortgage broker can help you understand the nuances of fixed-rate versus variable-rate mortgages and interest-only versus repayment options.

You'll benefit from their insights on which package offers the best value for your circumstances, allowing you to make an informed decision.

Moreover, they often have exclusive access to deals not available on the open market, which can be tailored to specific needs, such as self-employed individuals or buyers with a small deposit.

3. Completing the Application

Once you've found the right mortgage, the next step is completing the application. This stage involves providing detailed information about your income, assets, and debts.

Accuracy and thoroughness are paramount; any errors can delay or derail the application.

A mortgage broker will lead you through the maze of paperwork, ensuring every form is filled out correctly and every necessary document is submitted.

They will also liaise with lenders on your behalf, smoothing out any wrinkles that might crop up and keeping you updated throughout the process.

An often overlooked yet crucial part of the application is the property valuation. Lenders require this to ensure the property is worth the investment.

Throughout the mortgage application process, having a mortgage broker by your side can alleviate uncertainty and guide you toward making choices that are conducive to a successful and stress-free home purchase.

With their expert knowledge and bespoke advice, your path to homeownership becomes less daunting, allowing you to focus on what truly matters—making your dream home a reality.

Choosing the Right Mortgage Broker

1. Recommendations and Referrals

The journey to find your ideal mortgage broker often starts with personal recommendations. Ask friends, family, or colleagues who've recently navigated the property market about their experiences.

A broker with a strong track record of satisfied clients is likely to deliver the same high level of service to you. Moreover, online reviews and testimonials offer further insights into a broker's reputation.

Ensure you're looking at a varied range of sources to gauge a well-rounded view of the broker's performance and client satisfaction levels.

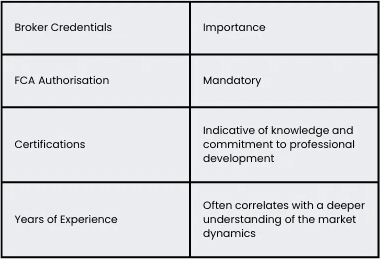

2. Credentials and Experience

It's paramount that your mortgage broker has the right credentials. In the UK, brokers should be authorised and regulated by the Financial Conduct Authority (FCA), ensuring they meet stringent professional standards.

A quick check on the FCA register can confirm their status.

Experience counts when it comes to navigating the complex mortgage landscape. Look for a broker with years of experience and a deep knowledge of the mortgage market.

Veteran brokers are often well-versed in finding deals that might not be directly available to the public and are skilled in handling complications that may arise during the application process.

3. Personalized Service

The hallmark of an exceptional mortgage broker lies in the personalized service they provide. Your financial circumstances are unique, and a one-size-fits-all approach won't serve you well.

A truly dedicated broker will invest time to understand your specific needs, financial situation, and future plans to secure a mortgage that aligns with your long-term goals.

Look for these indicators of personalized service:

A detailed initial consultation

Custom-tailored advice

Regular updates throughout the process

Availability to answer your questions

By choosing a broker who prioritizes personalized service, you'll be working with a professional who is committed to finding the best mortgage solution for you, not just a standard product.

A bespoke level of attention can be the difference between a good and a great mortgage deal.

Remember, taking the time to select the right mortgage broker is an investment in your homeownership journey.

With a thorough approach toward recommendations, credentials, and personalized service, you're well-equipped to forge a partnership that can navigate you successfully through the complexities of the mortgage market.

Frequently Asked Questions

1. What are the key benefits of using a mortgage broker?

A mortgage broker provides access to multiple loan options, negotiates better rates, and suggests terms tailored to your financial situation, facilitating a smoother home buying experience.

2. How can a mortgage broker help me get better rates?

A mortgage broker compares loans from various lenders to secure more competitive rates that align with your financial circumstances and homeownership goals.

3. What should I do to prepare my finances before applying for a mortgage?

Before applying, it’s crucial to review your credit score, budget responsibly, save for a down payment, and organise your financial documents for assessment.

4. Why is it important to find the right mortgage deal?

Securing the right mortgage deal can save you money over time by offering lower interest rates and better terms that match your financial plan and homeownership objectives.

5. What is the role of a mortgage broker in the application process?

Mortgage brokers guide you through the application, ensuring accuracy, helping with the necessary paperwork, and advising on property valuation, which eases the complexity of the process.

6. How do I choose the right mortgage broker?

To choose the right mortgage broker, seek recommendations, verify their credentials and experience, and ensure they offer personalized services meeting your specific needs.

7. Can a mortgage broker really make the home-buying process less daunting?

Yes, a mortgage broker can demystify the home buying process by providing expert knowledge, simplifying complicated steps, and personalising their service to reduce the overall stress involved.

Conclusion

Navigating the mortgage maze can be complex but you don't have to go it alone. With a mortgage broker by your side, you'll unlock doors to deals that might otherwise remain closed.

They'll tailor solutions to your financial landscape ensuring you're stepping onto the property ladder with confidence. Remember their expertise is your advantage in securing not just a mortgage but the right mortgage.

So before you dive into the housing market consider the value a mortgage broker brings to your home-buying journey. They're not just a guide; they're the compass that leads you to the doorstep of your future home.

This content is for informational purposes only and should not be construed as financial advice. Please consult a professional advisor for specific financial guidance.

Similar articles

July 3, 2025

Established fact that a reader will be distracted by the way readable content.

July 2, 2025

Established fact that a reader will be distracted by the way readable content.

June 19, 2025

Established fact that a reader will be distracted by the way readable content.